Momentum Radar

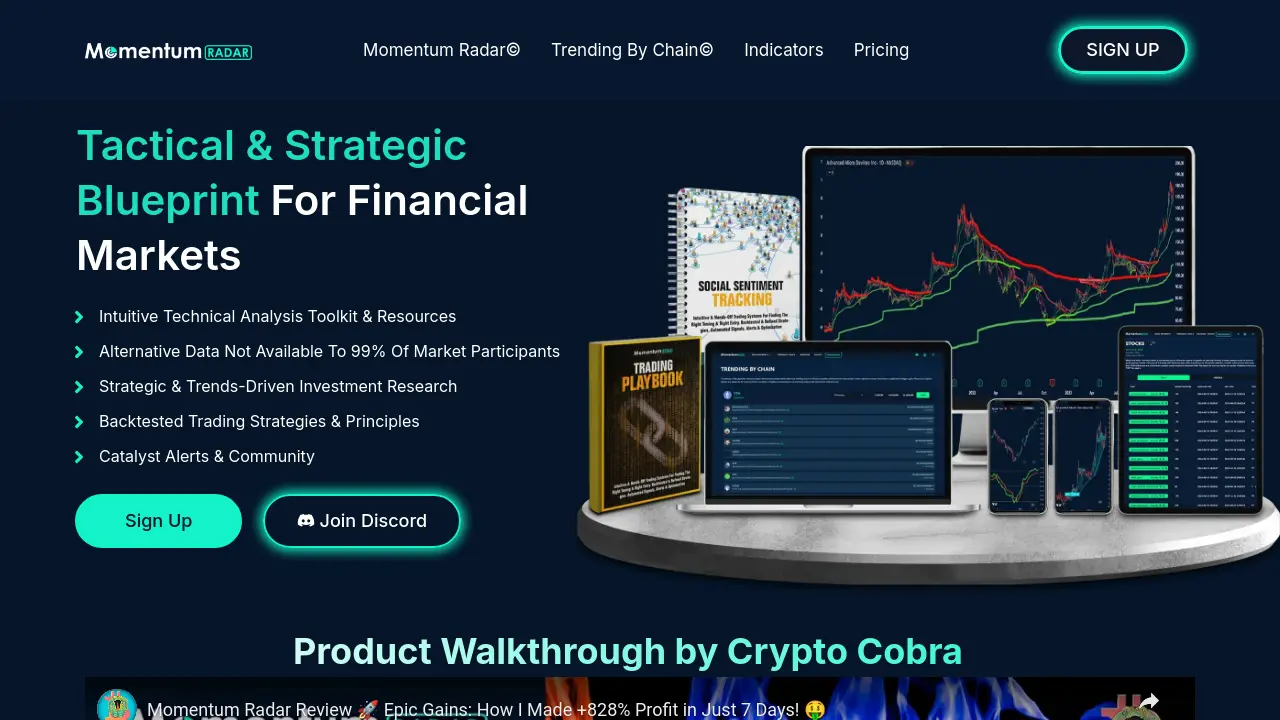

Tactical & Strategic Blueprint For Financial Markets

Description

Momentum Radar provides a comprehensive suite of tools and resources designed to offer traders and investors a clearer view of financial market conditions. It specializes in cutting through informational noise by offering unique alternative data sources, such as social sentiment tracking across major platforms, alongside intuitive technical analysis indicators.

The platform aims to simplify market complexities, identify institutional-level trading zones, and streamline research for assets including stocks and cryptocurrencies. By providing access to backtested strategies, strategic investment research, catalyst alerts, and a dedicated community, Momentum Radar assists users in navigating market volatility and making informed decisions.

Key Features

- Social Sentiment Tracker: Monitors market sentiment across major social media and news platforms for stocks, crypto, IPOs, etc.

- Momentum Indicators: Suite of proprietary technical analysis indicators including Institutional Algo, Momentum Radar, and Momentum Wave.

- Trending by Chain Algorithm: Identifies trending cryptocurrencies based on technicals, volume, liquidity, and on-chain activity.

- Momentum Trading Playbook: Educational resource covering trading concepts, market structure, indicator usage, and specific setups.

- Alternative Data Access: Provides unique market data streams not widely available.

- Backtested Trading Strategies: Offers access to historically tested trading principles and strategies.

- Catalyst Alerts & Community: Delivers alerts on market-moving events and provides access to a community Discord server.

- Investment Portfolio Access: Includes insights from a curated Momentum Investment Portfolio.

Use Cases

- Analyzing market sentiment to gauge trends.

- Applying technical indicators for buy/sell signals.

- Identifying trending cryptocurrencies using on-chain data.

- Learning and implementing momentum-based trading strategies.

- Streamlining research across stocks and crypto markets.

- Detecting potential institutional trading activity.

- Staying informed about market catalysts and news.

- Accessing alternative data for a trading edge.

You Might Also Like

Rowfill

FreemiumOpen Source Document Processing Platform

DeepAR

FreemiumHighly Scalable AR SDK for Face, Body, and Shopping Experiences

Diglot

FreemiumBilingual Text Editor with AI Co Writer in one App

Romo AI

Free TrialAll Super AI Tools in One Place

Clonify

FreemiumOnline UI Design Tool for Stunning Interfaces