Rocket Money

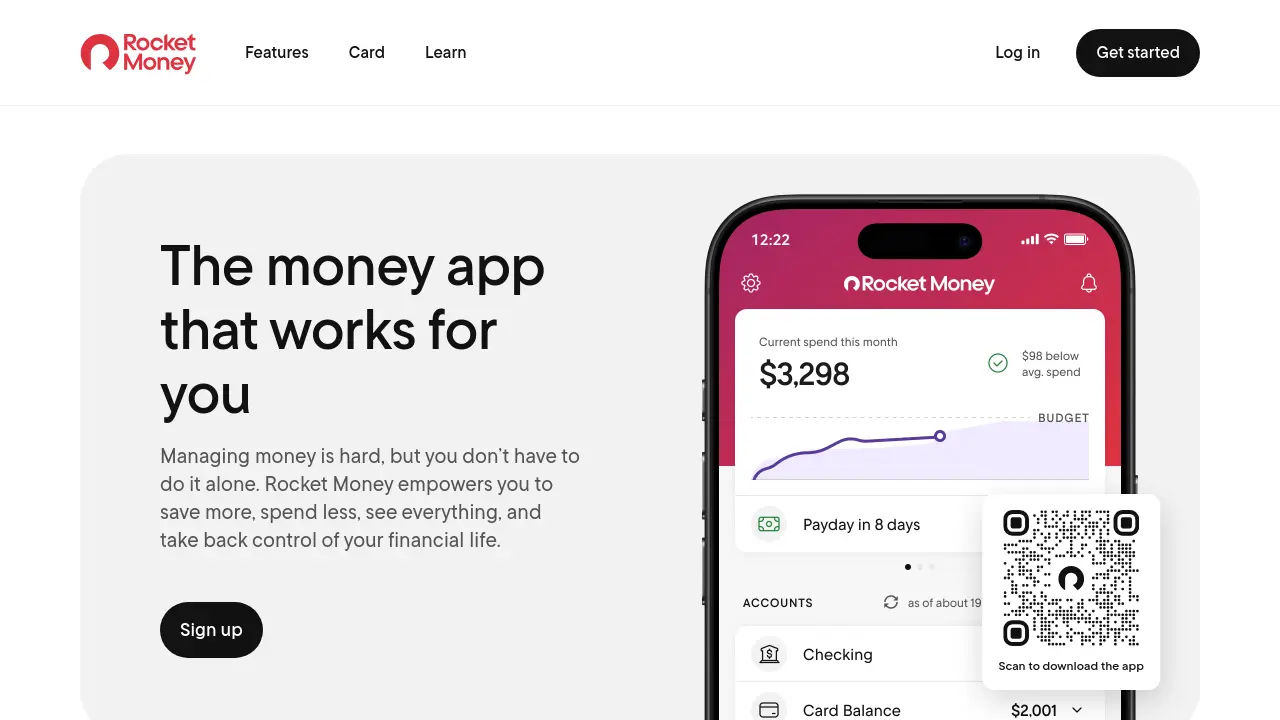

The money app that works for you

Description

Rocket Money is a comprehensive personal finance application aimed at empowering users to improve their financial health. It provides tools to help individuals save more money, reduce spending, and gain a clear overview of their entire financial picture. The platform utilizes smart technology to automatically identify and track recurring subscriptions and bills, offering assistance in cancelling unwanted services.

Furthermore, Rocket Money offers features for detailed spending analysis, enabling users to understand where their money goes and identify areas for improvement. It facilitates automated savings by learning user habits and transferring funds appropriately while helping to avoid overdraft fees. Users can also track their credit score, create budgets, monitor their net worth, and even utilize services for bill negotiation to potentially lower regular expenses. The app consolidates various financial accounts (checking, savings, credit cards, investments) into a single dashboard for holistic financial management.

Key Features

- Account Linking: Connect checking, savings, credit cards, and investment accounts.

- Subscription Management: Automatically finds and tracks recurring subscriptions.

- Subscription Cancellation Assistant: Premium service to cancel subscriptions on the user's behalf.

- Spending Tracking & Insights: Provides breakdowns of spending and notifies of important financial events.

- Automated Savings: Learns user habits to save money automatically and helps avoid overdraft fees.

- Balance Alerts: Notifies users of low balances or high credit spending.

- Budgeting Tools: Create and monitor budgets by category.

- Credit Score Tracking: Access credit reports, history, and receive alerts on changes.

- Bill Negotiation: Concierge service identifies and negotiates lower rates on bills.

- Net Worth Tracking: Consolidates assets and debts to track financial progress.

Use Cases

- Managing personal finances comprehensively.

- Tracking and cancelling unwanted subscriptions.

- Monitoring daily spending habits.

- Automating savings towards financial goals.

- Creating and sticking to a budget.

- Tracking credit score and history.

- Negotiating lower rates on recurring bills.

- Understanding and growing personal net worth.

- Consolidating financial information in one place.

You Might Also Like

Glocal SEO Platform

PaidGlocal SEO Boost my website in one click. Simple international SEO tool

CalendarPlusAI

Usage BasedCreate Fully Customized Calendars Using AI

ContentFries

FreemiumAI-powered video repurposing and content creation.

Art Of Green Path AI Consulting

PaidEmpower Your Business with Customized AI Solutions

Monument

Free TrialKeep your photos private, secure, and organized