RunStocks

Analyze Historical Small Cap Gaps and Runs for Data-Driven Trading Decisions

Description

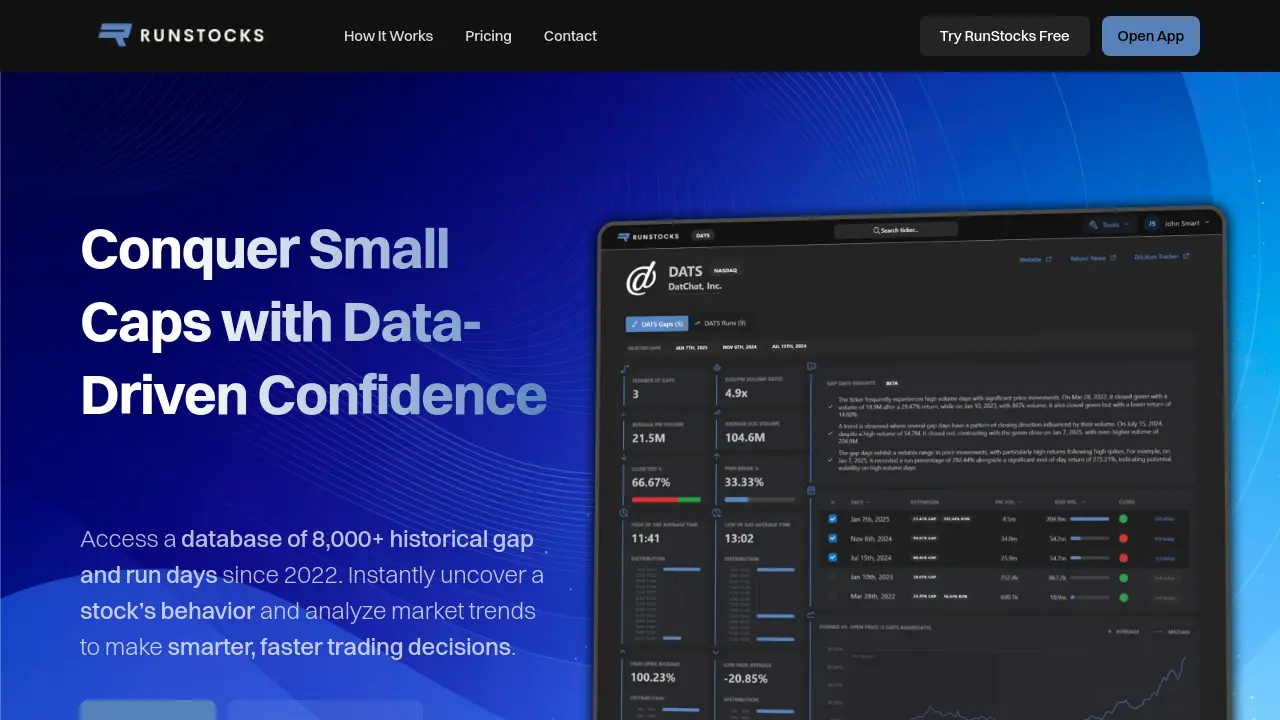

RunStocks is an analytics platform specifically designed for small-cap day traders seeking to gain an edge through data. It provides access to an extensive database covering over 8,000 historical gap (20%+) and run (50%+) events for small-cap stocks listed on NASDAQ, NYSE, and other markets, dating back to 2022. The primary goal is to empower traders to move beyond guesswork by analyzing how specific stocks have historically behaved following significant pre-market moves or intraday surges, enabling more informed and confident trading decisions.

The platform allows traders to delve into historical patterns by examining key fundamental data such as float size, outstanding shares, and ownership details alongside detailed technical analysis. Users can explore past events using 1-minute candlestick charts and filter historical gaps and runs based on characteristics matching current market conditions, like pre-market volume or gap percentage. RunStocks also incorporates market trend monitoring and AI-enhanced features that summarize stock information and generate key takeaways from historical behavior, streamlining the analysis process for identifying potential trading opportunities like breakouts, scalps, or fades.

Key Features

- Stock-Specific Character Analysis: Uncover unique trading characteristics and behavioral patterns for individual tickers.

- Intraday Price Action: Access detailed 1-minute candlestick data for historical gap/run days to recognize patterns.

- Daily Adjustments for Reverse Splits: Ensures historical data accuracy by automatically adjusting for reverse splits daily.

- Comprehensive Historical Data: Analyze an extensive database of small-cap gaps (20%+) and runs (50%+) from 2022 onward.

- Mobile-Optimized Platform: Access data seamlessly on any device for on-the-go trading analysis.

- Detailed Performance Metrics: Analyze price movement, volume trends, pre-market high breakouts, peak times, and spike/fade percentages.

- Market Trend Monitoring: Track recent market-wide trends to assess if conditions favor long or short setups for gaps/runs.

- End-Of-Day Calendar of Gaps & Runs: Track recent gaps and runs for potential second-day play opportunities.

- Fundamental Data Access: Provides critical fundamental data like market cap, float, outstanding shares, and ownership percentages.

- AI-Enhanced Insights: Offers AI-powered summaries of stock data and key takeaways from historical behavior analysis.

Use Cases

- Analyzing historical performance of gapping small-cap stocks.

- Identifying potential day trading setups based on past behavior.

- Understanding a specific stock's typical reaction to gaps or runs.

- Filtering historical data to match current market conditions.

- Anticipating market moves based on historical patterns.

- Preparing for different trading scenarios by studying past price action.

- Finding second-day trading opportunities.

- Assessing market trends for small-cap momentum.

Frequently Asked Questions

What is a gap? What is a run?

A gap occurs when a stock opens at a significantly higher price than its previous close, creating a price "gap" on the chart. RunStocks focuses on gap-ups of 20% or more, which often indicate strong momentum and potential trading opportunities. A run refers to an intraday price movement where a stock gains at least 50% from its opening price, signaling extreme volatility and potential setups for traders.

How accurate is RunStocks data?

RunStocks ensures data accuracy by processing daily market updates, adjusting for reverse splits, and cross-checking with multiple data sources. Our calculations for gaps, runs, volume trends, and price action metrics are based on high-quality market data, providing traders with reliable insights for decision-making.

How often is RunStocks data updated?

RunStocks updates its data daily, ensuring traders have access to the latest gap and run events as soon as the market session ends. We also adjust historical data for reverse splits to maintain accuracy in all calculations.

Does RunStocks cover all stocks?

RunStocks focuses primarily on small-cap stocks with significant price movements. While we track thousands of tickers, our platform is optimized for stocks that exhibit high volatility, large gaps, and explosive runs, making it an essential tool for day traders.

Can RunStocks integrate with existing tools?

At the moment, RunStocks data can only be accessed through the app.runstocks.com portal. However, we're actively working on providing a full-fledged API for our customers, so you can integrate our data into your own tools or programmatic strategies.

You Might Also Like

Pandalyst

FreemiumGenerate optimized SQL queries effortlessly using AI, regardless of your skill level!

Credit Card Generator

FreeGenerate Valid, Random Credit Card Numbers for Testing

WonderTale

FreemiumCo-Create Magical AI Stories for Children

EPIGON.AI

OtherYour AI Companions for Storytelling and Roleplay

VOC AI

FreemiumBuild your winning products within minutes