Fintool

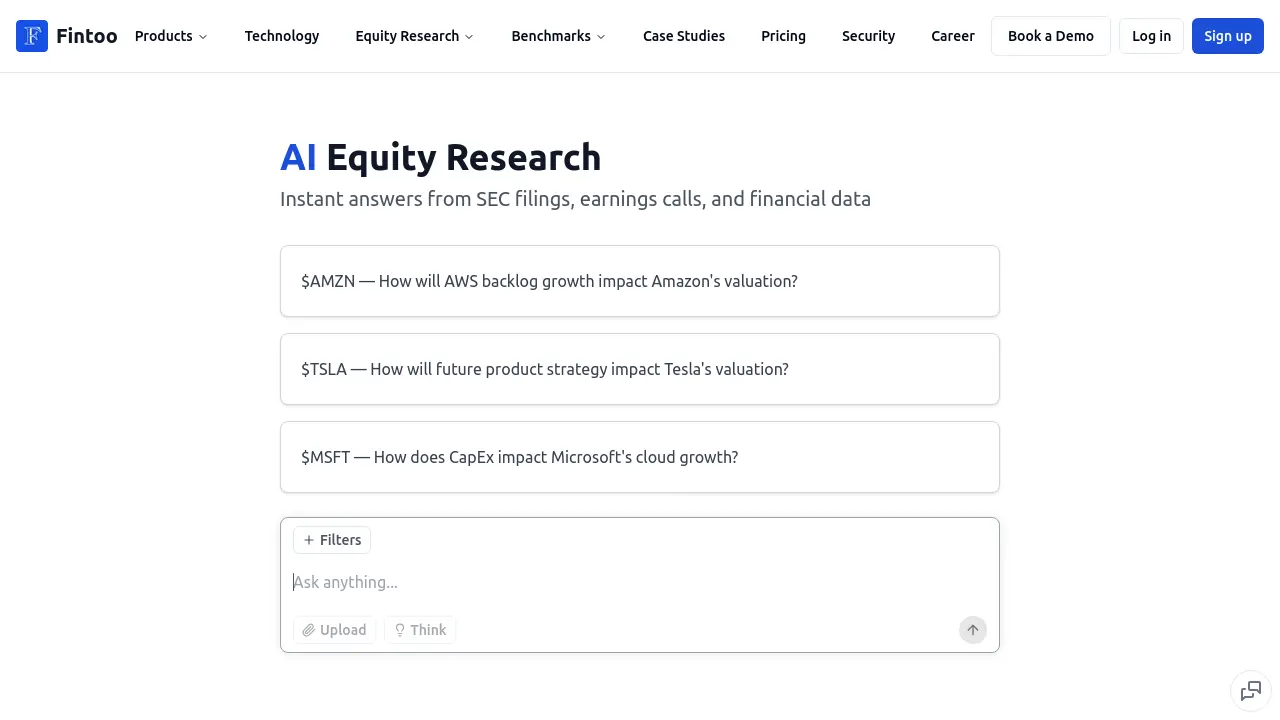

AI Equity Research

Description

Fintool is an AI platform designed to streamline financial research for investment professionals. It offers a suite of tools that leverage artificial intelligence to analyze vast amounts of financial information, including SEC filings (10-K, 10-Q, 8-K, proxy statements), earnings call transcripts, investor day presentations, and real-time financial data. The platform aims to provide quick, accurate answers to financial questions and facilitate deeper company and industry analysis.

Key components include an AI chat assistant for querying financial documents, a company screener for identifying industry trends based on earnings calls and filings, a real-time AI feed for tracking news like 8-K filings, comprehensive equity research reports, and an API for programmatic access to financial data. Fintool emphasizes data accuracy, sourcing information from trusted financial documents and offering enterprise-grade security features, including end-to-end encryption and isolated data storage. It benchmarks its financial LLM performance against competitors, highlighting its accuracy in financial data interpretation.

Key Features

- AI Chat Assistant: Ask financial questions and get answers sourced from SEC filings and earnings calls.

- Company Screener: Analyze industry trends by screening earnings calls and 10-K filings.

- Real-time AI Feed: Delivers timely updates on significant company events like 8-K filings.

- Equity Research Reports: Access comprehensive analyses of companies, including business models, financial metrics, and forecasts.

- LLM API Access: Programmatically access financial data via a REST endpoint (Enterprise plan).

- Internal Data Integration: Securely connect proprietary firm data for enhanced analysis (Enterprise plan).

- Comprehensive Data Sources: Aggregates data from SEC filings, transcripts, real-time financials, and allows internal data connection.

- Enterprise-Grade Security: Features end-to-end encryption, compliant data storage, and dedicated cloud environments.

Use Cases

- Answering specific financial questions about companies (e.g., CAPEX impact, backlog growth).

- Screening multiple companies for specific industry trends or topics discussed in earnings calls.

- Staying updated on real-time company news and filings.

- Conducting deep-dive equity research on individual companies.

- Analyzing merger synergies across historical earnings calls.

- Building custom financial applications using the API.

- Integrating firm-specific knowledge with public financial data for analysis.

You Might Also Like

Sekel Tech Omnilocal Platform

Contact for PricingBridge the Gap Between Click and Counter: From “Near Me” Searches to Doorstep Delivery — Sekel Tech’s Omnilocal Platform Makes It Happen.

Cruip

Pay OnceTailwind CSS templates for professional web projects

DiffEngineX

Free TrialAdvanced Excel Workbook Comparison for Detailed Analysis

Ace Interview Assistant

FreemiumGet real-time AI assistance during interviews to help you answer all questions perfectly.

PDF PDF

FreeFree Online PDF Toolkit for Conversion, Merging, Splitting, and More